Our BittsAnalytics platform offers our clients a multitude of strategies for generating alpha – from using real-time sentiment (for more information see e.g. blog posts about BittsSignals), social media mentions, AI analysis of clustered themes, price signals, Bitts Ranks and others. In this post we would however like to introduce you to a remarkable performance of a strategy better known from traditional finance – dynamic allocation. We use dynamic allocation between cryptocurrencies based on Mean CVaR porfolio optimisation, which better captures fat tails and is thus better suited for the volatile world of cryptocurrencies as opposed to more widely known and technically much simpler mean variance method.

To illustrate the power of dynamic allocation we intentionally chose a conservatively constructed portfolio consisting of only the “old” coins with longer histories – Bitcoin, Ethereum, Litecoin, Monero, Dash, NEM and Augur. Dynamic allocation was performed by determining optimal portfolio every five days and investing in it at close prices (UTC time). Portfolio optimisation objective for this presentation was the maximization of expected risk adjusted return (R-lambda*CVaR, lambda=0.01). Returns were historically approximated with sliding 10-day window. While the results presented here are for a certain set of parameters they are remarkably robust over the wide parameter grid and the chosen set is not even the one with the best performance. We will post results for the multidimensional grid of parameters in later post.

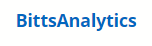

Let us look first at the NAV curve (period is from start of 2017 to 7th November 2017).

The Crypto Portfolio (orange line) is the NAV line of the dynamic allocation strategy. What is remarkable is that not only it outperforms the benchmark it outperforms all of its constituents (we chose Ethereum as benchmark as it is rather demanding in year 2017, we will post comparisons to other benchmarks in follow-up posts) . We have done hundreds of similar strategies in the traditional finance for various clients with portfolios consisting of ETFs, mutual funds or stocks for a wide variety of purposes including for robo advisors. In almost all such cases the outperformance of all of its members never occured. One insight from this result is that the cryptocurrencies are still sufficiently distinct from each in the temporal distribution of returns. This makes dynamic allocation based on Mean CVaR very promising indeed.

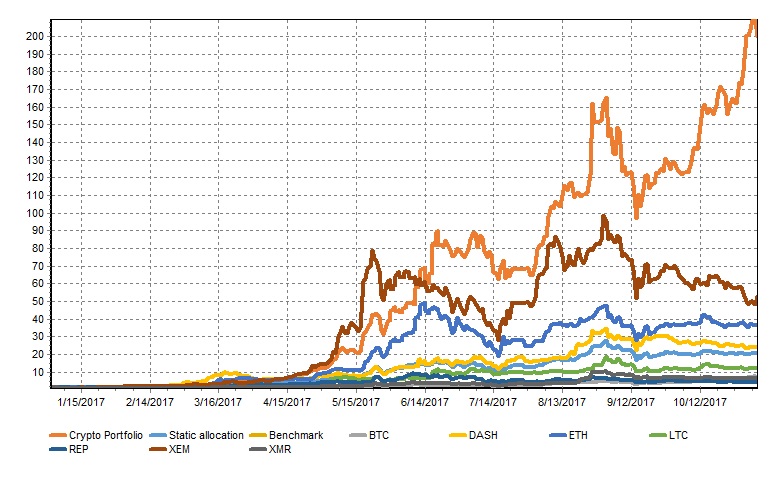

Let us look next at composition of optimal portfolio over time.

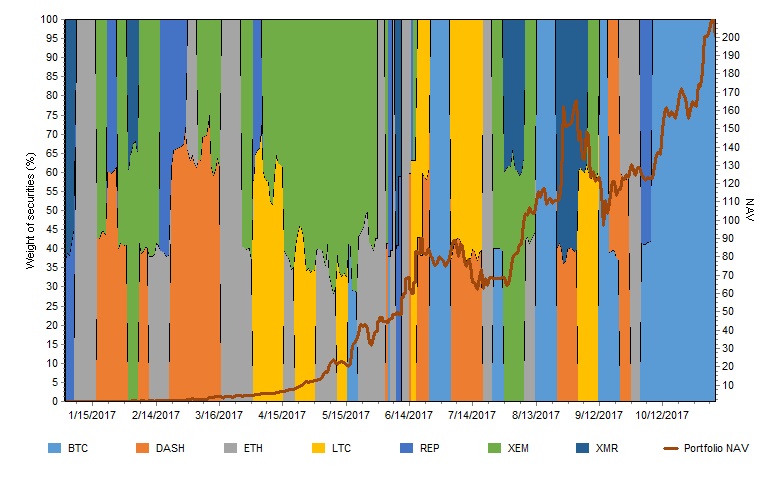

The weights were limited at maximum 60% except for Bitcoin and Ethereum which could reach 100% share. In the first half of the year Ether was several times the preferred allocation while in the last few months the optimal portfolio was dominated by Bitcoin. This is also seen from the following chart of average weights over this period of the cryptocurrencies with Ether having the highest share followed by NEM and Bitcoin.

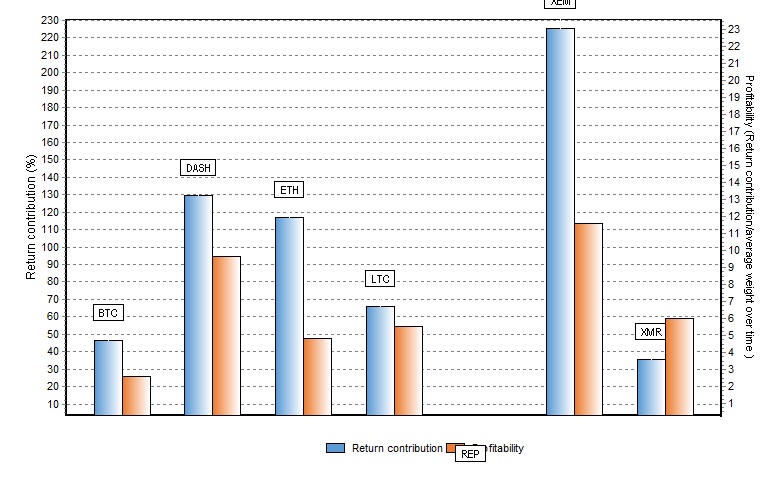

It is also interesting to examine return contributions, see the chart below.

The highest contribution came from NEM followed by Dash and Ethereum. Profitability (return contribution divided by average time share) was also highest for Nem followed by Dash.

We conclude with performance and risk statistics of the results as well as comparison with the benchmark (Ether). Dynamic allocation strategy vastly outperformed the benchmark (alpha of over 10.000%) while achieving this with 20 percentage points lower maximum drawdown. Better risk adjusted performance is also reflected in a better Sharpe ratio.

We would also like to note that the strategy based on dynamic allocation presented is with a rather long rebalancing period of a few days. Application on smaller time scales with rebalancing period reduced from days to minutes or even less can lead to potentially even greater performance.

Finally we would like to highlight another advantage of dynamic allocation. It can effectively help with one of the biggest future problems of cryptocurrency funds – dealing with periods of severe market downturns. We will show how dynamic allocation combined with cash asset can alleviate this problem in one of our future blog posts.

If you are interested in having your portfolio optimised with mean CVaR portfolio optimisation as well as receive the backtesting results send us an email at [email protected] and we can send you price quotes for monthly, weekly or daily rebalancings.

Mean CVaR framework will later also become available for users of our BittsAnalytics platform, you can already start using some of our powerful analytical tools by subscribing to one of our subscriptions at https://www.bittsanalytics.com/subscribe.php

Related posts

BittsAnalytics

BittsAnalytics is an advanced data and analytics platform for cryptocurrencies.

Learn moreNewsletter

Categories

- aelf

- Aeternity

- AiDA

- Aragon

- Ark

- Bancor

- Bitcoin

- Bitcoin Cash

- BittsBands

- BittsDynamicAllocation

- BittsSignals

- BittsTagcloud

- BittsThemes

- cardano

- Correlations

- DASH

- Digibyte

- Earthcoin

- Electroneum

- EOS

- Ethereum

- Golem

- ICO

- Lisk

- Litecoin

- Lunyr

- Market Sentiment Indicator

- Monero

- MSI

- NEO

- OMG

- Particl

- Populous

- QTUM

- RChain

- Real-Time Analytics

- Relative Strategies

- Ripple

- Sentiment

- Siacoin

- Status

- StellarLumens

- Stratis

- Tron

- Uncategorized

- Verge

- XLM

- ZCash