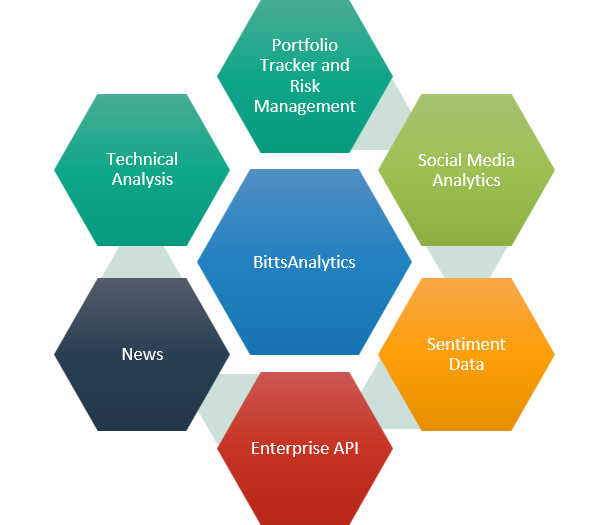

BittsAnalytics

Social Media Sentiment

We use machine learning to determine social media sentiment for each cryptocurrency so you can see when the investors are euphoric or gloomy. We have sentiment data since August 2017 giving you ability to assess both short-term and long-term sentiment trends.

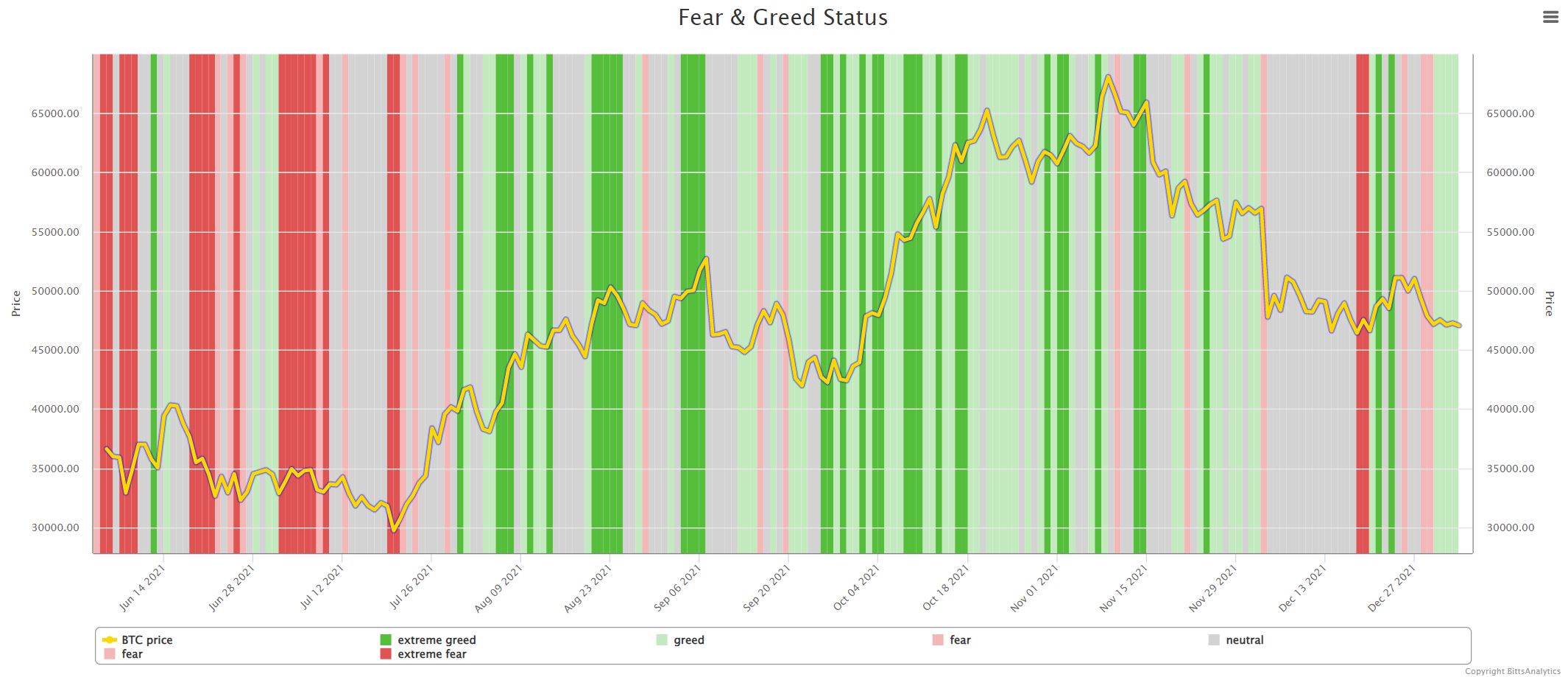

Crypto Fear Greed Index and Investor Indices

Crypto Fear & Greed Index captures overall positive and negative emotions as expressed by users on social media and provides useful insight in current mindframe of crypto market. Our advanced Investor Indices are based on social media opinions of traders, hedge funds and other professional investors.

Most shared news for each cryptocurrency

We determine the most shared news on social media for each cryptocurrency, from millions of social media posts each day. And plot these news on price charts so that you can see which news is impacting the price of cryptocurency.

Historical simulation

Do you know how much your current portfolio has gained or lost in recent period? You can enter your portfolio on our platform and obtain historical simulation of your current portfolio performance in the past*.

Social Media Mentions

We determine the number of mentions of each cryptocurrency on social media, so that you can see which coins are most talked about at the moment. With historical data since 2017, we provide you with both short-term and long-term insights.

Support and Resistance Levels

We use complex algorithms based on trading data to compute support levels and resistance levels for prices. Support level is where the price is more likely to stop falling and makes a reversal back up, whereas the resistance level is where the price is more likely to stop rising and falls back down.

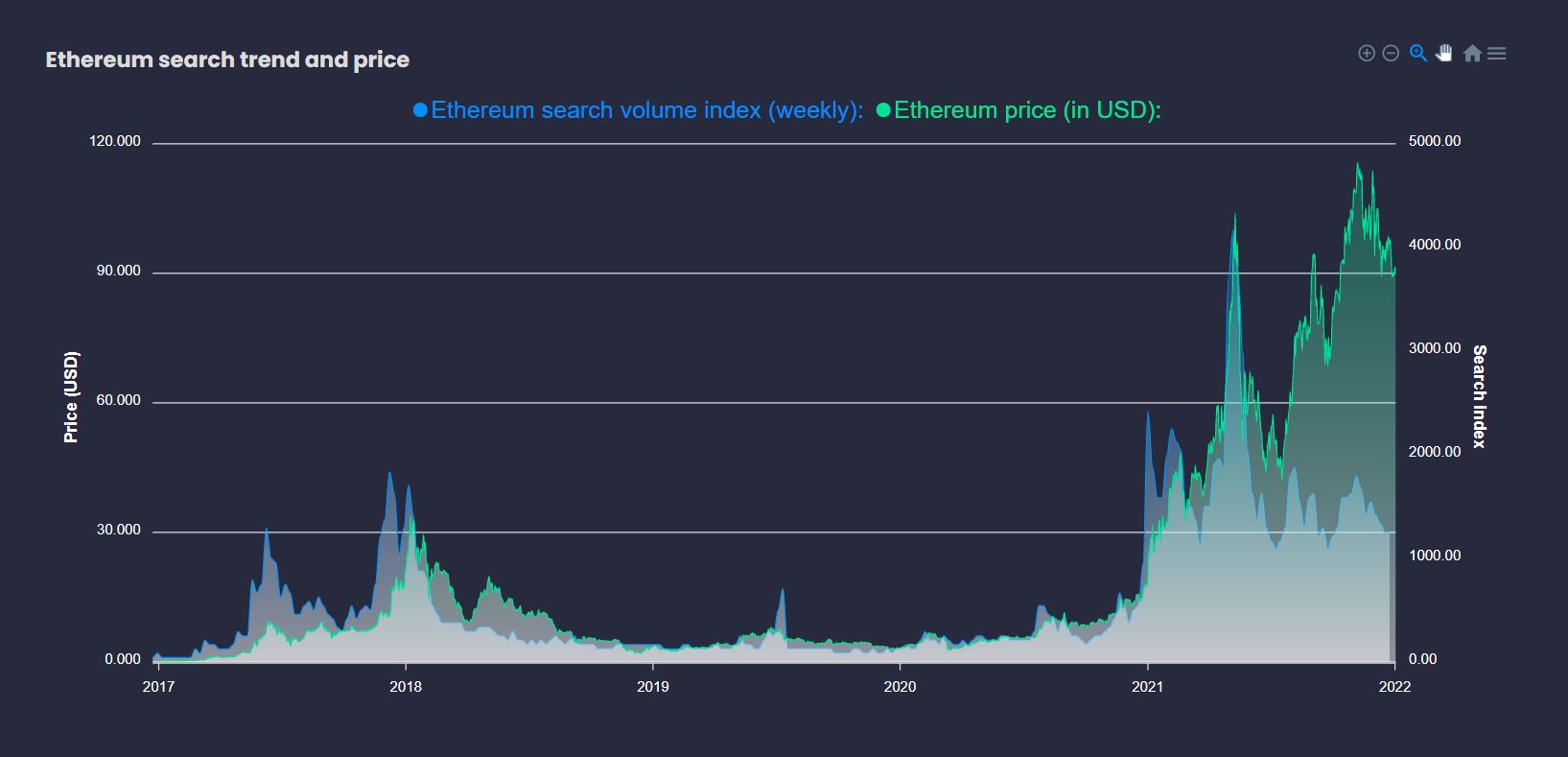

Search trends

Trends of searches on major search engines are a useful indicator of general interest in any given cryptocurrency. In our dashboard we provide you with historical charts of search trends for each coin that we cover.

Crypto Talk

We determine words that social media users most often use in positive/negative posts about given cryptocurrency in last 24 hours. So you can see which recent developments/topics are viewed as positive or negative for each cryptocurrency.

*Past performance of cryptocurrencies may not be indicative of future results.

Check video of our platform

Our platform gives you cutting edge analytical tools that are needed for staying on top of the cryptocurrency markets.

Each day, we analyze millions of social media posts and market-moving news, calculating mentions and sentiment about individual coins in real-time to give you an edge over your competition.

Social media sentiment is computed using a machine learning model that we trained on millions of labelled tweets. Our machine learning model is adapted to financial domain, it is especially sensitive

to words that convey sentiment in financial language - rising, falling, bear market, bull market, etc.

We also provide you with several advanced tools for technical analysis. We use complex algorithms to detect support and resistance levels of cryptocurrencies and automatically identify, generate and plot trendlines on our charts.

Our tools can you help evaluate which cryptocurrencies will survive in the future.

On our platform you can enter your current portfolio and use our historical simulations to see how it performed in the past.

Check out sample data sets of our cryptocurrency historical data.

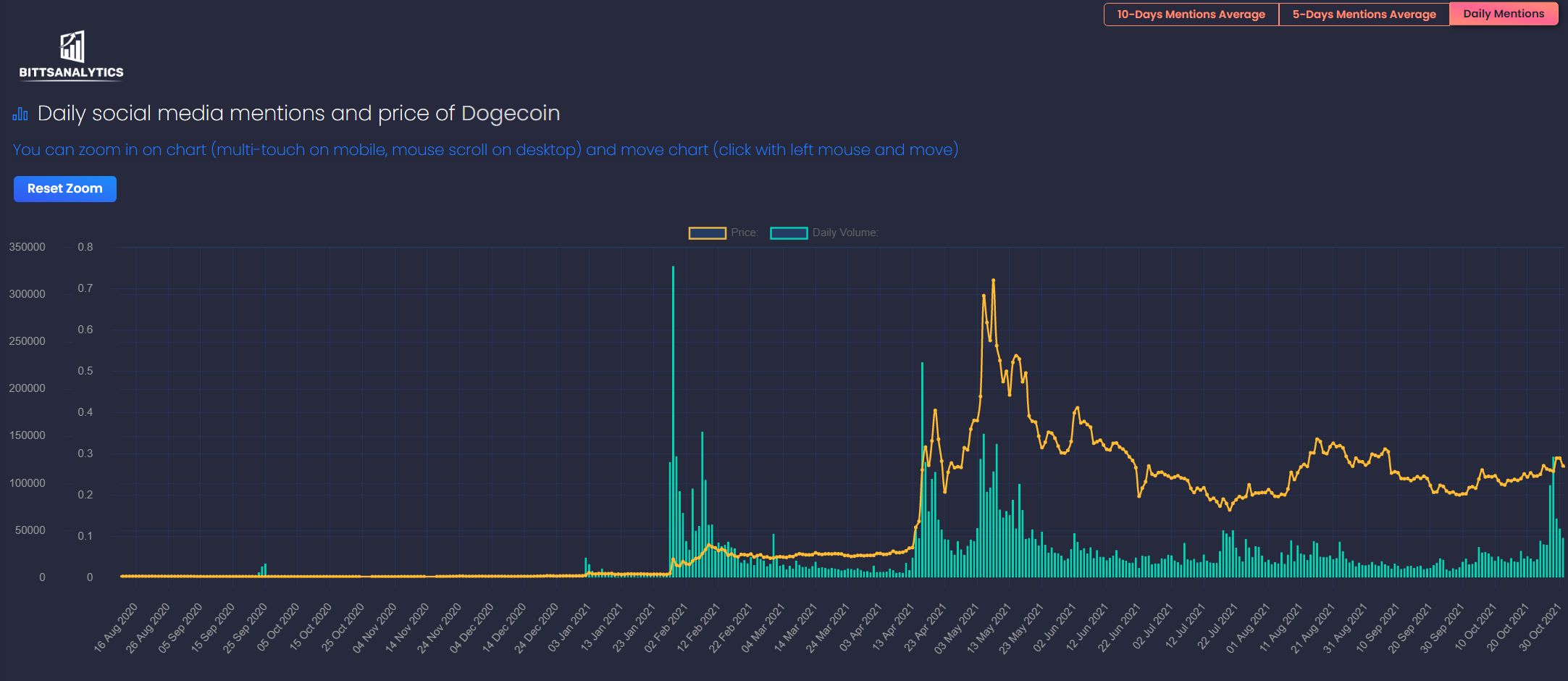

Prices of many assets are influenced by the hype and number of social media mentions about them. Often it is very worthwile to know which cryptocurrencies are the main talk of the crypto world or which

are experiencing a sudden surge in interest.

Click in the chart on the left and see how there was years of disinterest in Dogecoin on social media, followed by spikes in social media mentions along with price rise.

We are calculating number of mentions for cryptocurrencies in social media to find surges in interest as well as deliver historical comparisons and analysis.

BittsAnalytics can thus serve as a very effective crypto social media tracker of cryptocurrencies.

Start exploring

Prices of certain assets are importantly driven by the sentiment and hype about them. By subscribing to BittsAnalytics you can easily access cryptocurrency sentiment data in real-time

and in historical chart.

For calculation of social media sentiment, we use a machine learning model that was trained on millions of labelled tweets. Our machine learning model is adapted to financial domain, it is

especially sensitive

to words that convey sentiment in financial language - rising, falling, bear market, bull market, etc.

We provide you with Bitcoin Sentiment Index, Ethereum Sentiment Index and sentiment indices for all other cryptocurrencies.

All of our sentiment data is also available as API.

We compute our Crypto Fear & Greed Index from sentiments of 1+ million social media posts that are published each day about cryptocurrencies. We use machine learning model for computation of posts sentiment.

Unlike some other indices we do not include prices/volatility because this is already captured in prices itself.

Our crypto fear and greed index is thus entirely based on opinions/sentiment of people towards cryptocurrencies and we believe this "pure" aspect is a better way of measuring and capturing greed and fear in the crypto markets.

Start exploring

Our platform computes support and resistance levels for all assets that we cover. Support levels are price ranges where the price

can potentially bounce back (when falling from above). Resistance levels are price areas where the price may fall down again (when rising from below) or bounce back again (when falling).

We also offer other technical analysis tools, including AI generated trendlines.

All of our technical analysis data is available as API.

An important indicator of interest in cryptocurrency is the number of search trends for coins on major search engines.

We collect this data and offer charts showing search trends overlayed with prices for each coin that we cover.

Search trends can be combined with social media mentions trends for deeper insights in popularity of coins.

To get a better understanding of what people talk about on social media regarding each coin in real-time, we compute the words most often used in social posts about each cryptocurrency.

We separate the words depending on whether they occurred in the sentiment positive or sentiment negative social media posts about the cryptocurrency.

So you can see which words and topics are positively impacting the cryptocurrency and which have a negative impact.

BittsAnalytics allows you to set up and track you own personalised portfolio.

You can easily track the changes in portfolio value

as well as individual cryptocurrencies of the portfolio.

To better understand the potential of your personalized portfolio we provide you with historical simulations.

Our Risk Management tools

such as risk attribution will help you understand where are the main risks hidden in your portfolio.

Risk metrics such as VaR and Maximum drawdown will help you understand

possible losses in adverse scenarios. See demo of Crypto Portfolio Tracker.

We determine all past bull and bear markets of each cryptocurrency and provide you with both charts and statistics on them.

Although history is not indicator of future, this historical analysis still gives you a rough overview of possible potential returns as well as possible losses, for each coin individually.

Our Investor Sentiment Index and Investor Social Buzz Index are based on evaluation of only those 1+ million crypto related tweets each day that were published by authors that we identified as investors and/or traders.

User is identified as investor/trader if profile description contains words like 'investor', 'trader', 'hedge fund', 'investing' and others.

From these posts we compute on hourly basis the average sentiment (Investor Sentiment Index) and total mentions buzz (Investor Social Buzz Index).

We believe these Investor Indices give an unique insight in the social activity and opinions of investors/traders in the crypto community.

Investor indices was developed by our machine learning consulting team.

Our influencer indices are computed by segmenting social media posts depending on the number of followers of the author, we distinguish between 3 group of authors:

- small following social media users - those that have less than 100 followers

- smedium following social media users - those between 100 and 1000 followers

- slarge following social media users - those with more than 1000 followers

We analyse millions of social media posts each day for mentions of news to find most shared news on social media about each coin.

We plot these news on price charts so you can more easily see which news is driving the price or how the news reacts to major price changes.

We also collect many of other news from thousands of different sources and classify them for sentiment using our SVM machine learning model. This sentiment classified news is also available as part of our API.

We are tracking thousands of news sources each day to find important and insightful news on cryptocurrencies in real-time.

We categorize news per cryptocurrency so you can easily see all the important news about a given cryptocurrency published in real-time.

Each news is also tagged with sentiment,

determined with AI research developed by our machine learning consulting, based on the text of the individual news. This gives you an additional way of searching for news and providing crypto news sentiment analysis about individual cryptocurrencies.

We are using cryptocurrency news in our AI lead generation tool.

In addition to top market capitalization coins, we also cover hundreds of others, including Litecoin, EOS, Binance Coin, Tether, Stellar, Cardano, Moneto, Dash, Tezos, Ontology, Maker, NEM and others.

Start exploring

Why BittsAnalytics?

BittsAnalytics is a high-quality platform which provides real-time, reliable and unique data REST APIs for the cryptocurrency market. We specialise in providing data sets with high impact on prices of digital assets: social media sentiment and social media mentions. Our APIs are used by many hedge funds and individual clients.

Cryptocurrency historical data API

We have been one of the early providers of crypto social media tracker. This allows us to offer our clients long historical ranges for our data, which is essential for building investment strategy models of high quality. We do not offer crypto API tiers based on number of ticker coins. With our plan you get data for all coins tracked.

Use cases

Use cases include systematic trading (a lot of our clients are hedge funds),market making, big data and data science products, portfolio value tracking.

Our data can also be used in other fields, e.g. for data visualization consulting services, coins with top mentions can be part of keyword, niche research tool,

that allows you to find best keywords for cryptocurrency.

Data Delivery

Our social media cryptocurrency data is delivered to you on-demand using well-documented and simpleHTTP RESTful API in JSON format. You can use our data in various

frameworks, including python, javascript, PHP, Microsoft Excel and on various operating systems, including Linux and Windows.

Access to data is granted upon purchase of our Advanced Plan, which provides you with your

crypto api private key.

Free Crypto News API

We are one of crypto saas companies that also offers for free a cryptocurrency news API. We track in real-time the most important stories related to Bitcoin, Ethereum, Ripple, Cardano, Tron

and many other coins. Each news story is analysed by our machine learning models which determine sentiment polarity of texts.. This allows us to determine sentiment of news both on aggregate levels as well

as for individual coins.

If you subscribe to one of our plans you obtain access to our news aggregator which contains Bitcoin news feed api, Ethereum news feed api and for other coins.

Dedicated Support

We are believers in customer satisfaction and will provide you with professional support with quick turnaround times.

Why cryptocurrencies?

Cryptocurrencies are based on blockchain technology, which allows solving many different customer pain points, from tracking and verifying ownership of assets to recording financial transactions, as part of DeFi (decentralized finance) area. More recently, blockchain has been powering the non-fungible tokens or NFT field.

main Cryptocurrencies

Sentiment and other data points generated (per month)

combinations of social media posts - cryptocurrencies analysed (per month)

Projects

Our company Alpha Quantum has developed a wide range of other platforms using machine learning and AI algorithms.

We invite you to check them out:

- - Product categorization API - supports Google product taxonomy and IAB classification, for both texts or webpages/URLs

- - Product tagging solution - generates up to 100 descriptive tags for your products, allowing you to enrich your website and improve search experience of your customers

- - Find products from 1+ million online shops - AI based, recommender solution to provide you with stores that sell a given ecommerce product

- - Find similar stores and search stores by category - AI driven solution allows you to find all stores that sell similar products to a given online shop. Online shops can quickly find their competitors while suppliers can quickly discover shops that are similar to existing customers.

- - Trending products - find search trends of products, by category. See which products are experiencing surge in interest and which stores sell them.