Investment strategy for a new asset class such as cryptocurrency has some specifics but generally should follow general principles valid for other asset classes. It should be chosen in a way that is appropriate for the investors. If someone is more interested in short-term movements and events it is more unlikely that choosing a long-term holding approach will be a successful one. And vice versa. In the following sections we will closely examine the long-term strategies (such as HODL) as well as short-term investment strategies. For the latter we will particularly look at some of the data that should be used in such case and analytical tools available to investor.

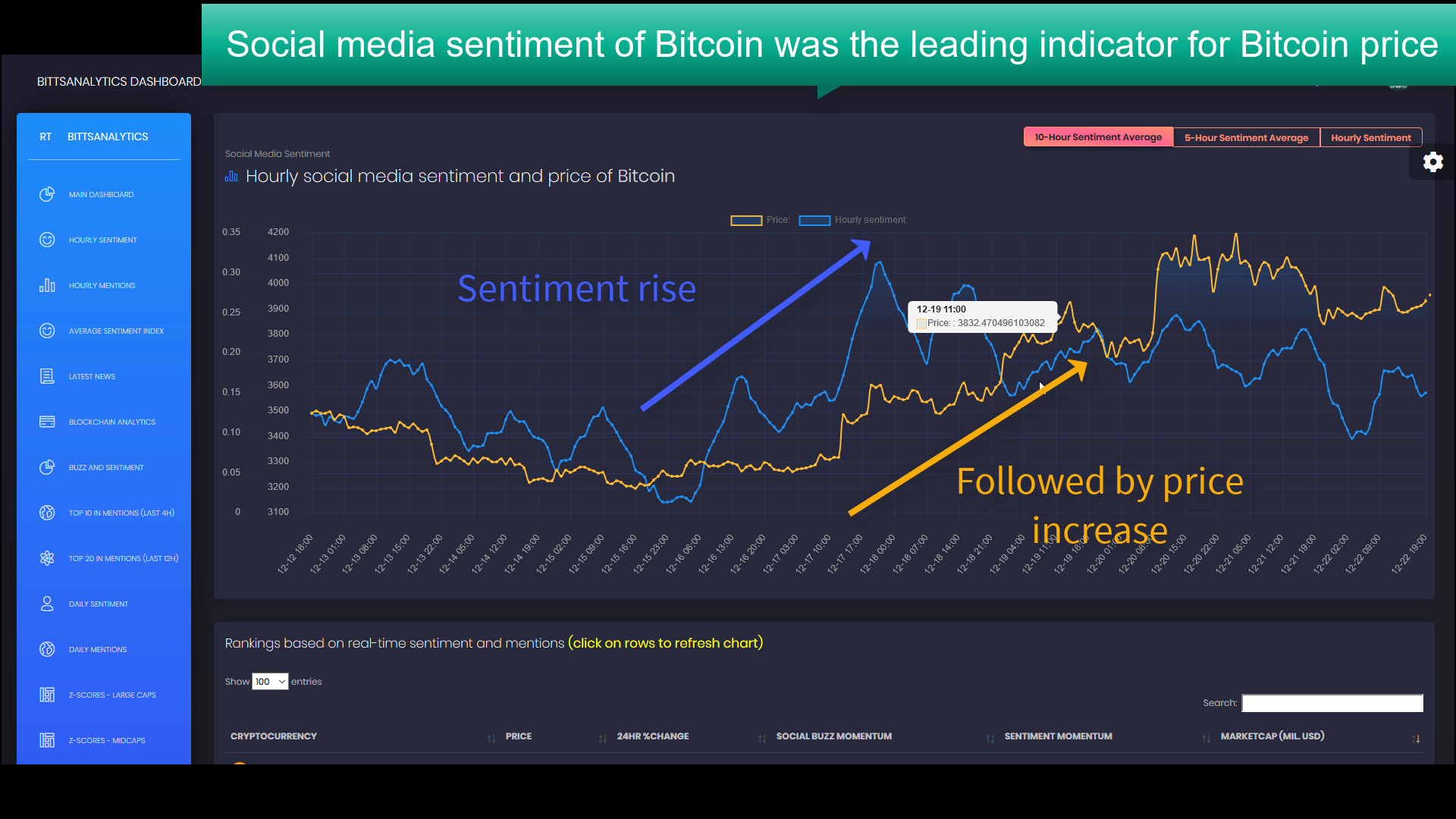

There is vast amount of social media posts published each day for cryptocurrencies. For example, more than 40.000 tweets are published daily just on Bitcoin. One type of short-term cryptocurrency trading strategy is to exploit these data by looking at the sentiment of social media texts published about each coin. Sentiment is determined by using machine learning (Support Vector Machines) from texts of social media posts. This approach can result in substantial trading profits. For examples of appyling real-time social media sentiment for trading, read several case studies below:

Ripple up more than 100% since a spike in social media mentions,

Electroneum up more than 100% since a sentiment signal from real-time analytics,

Nano up more than 50% since surge in social media mentions on 11th September,

RChain up more than 50% since surge in social media mentions on 9th September.

Start exploring

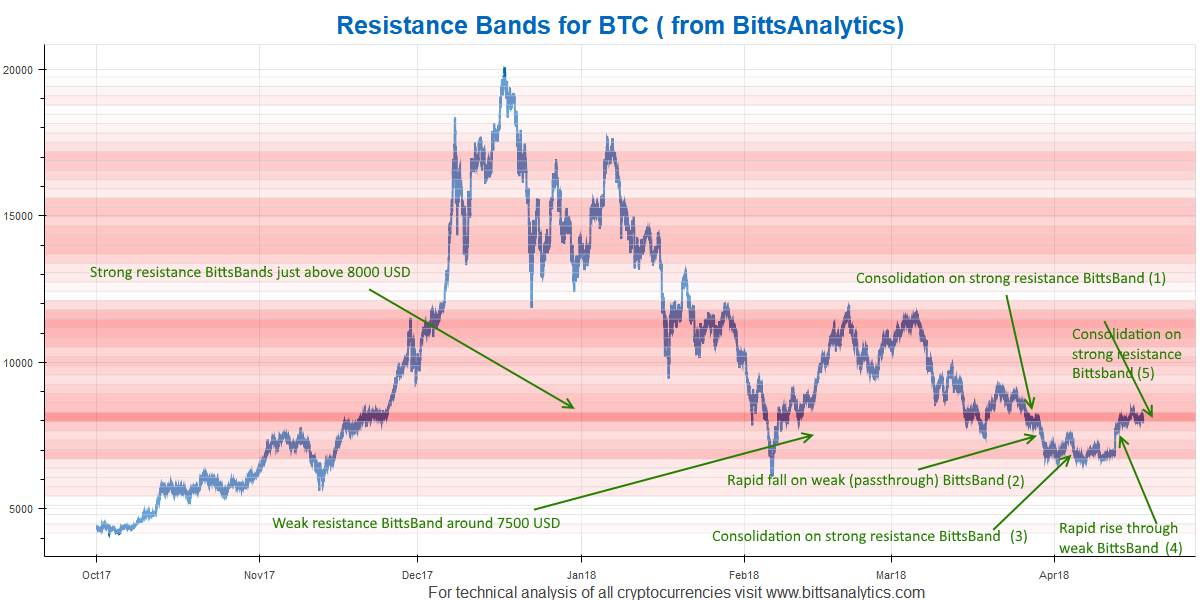

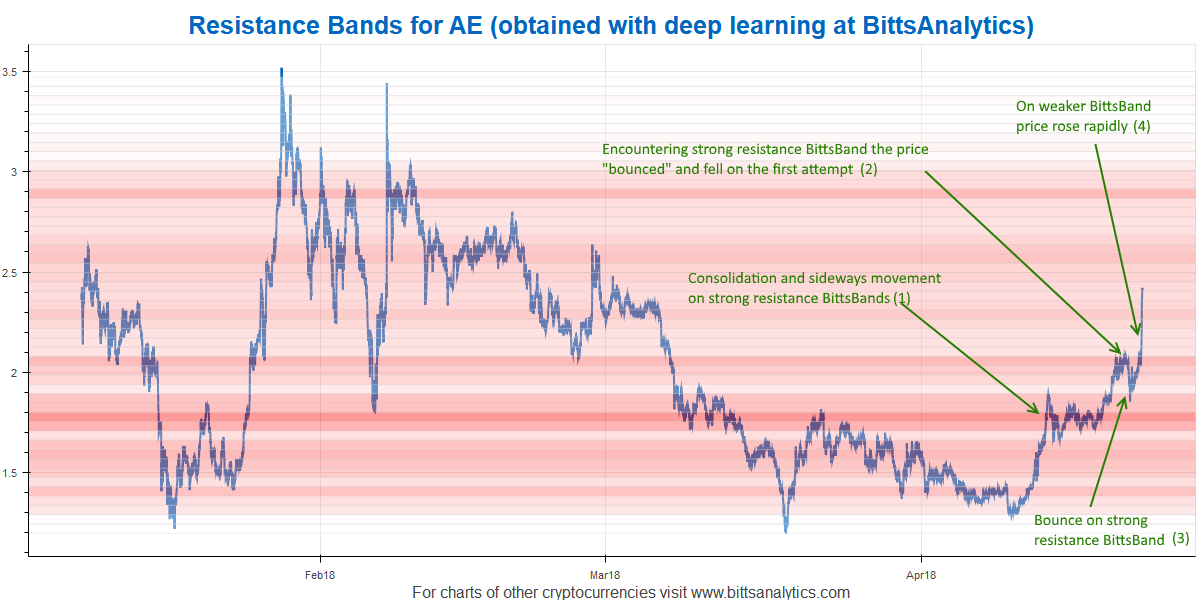

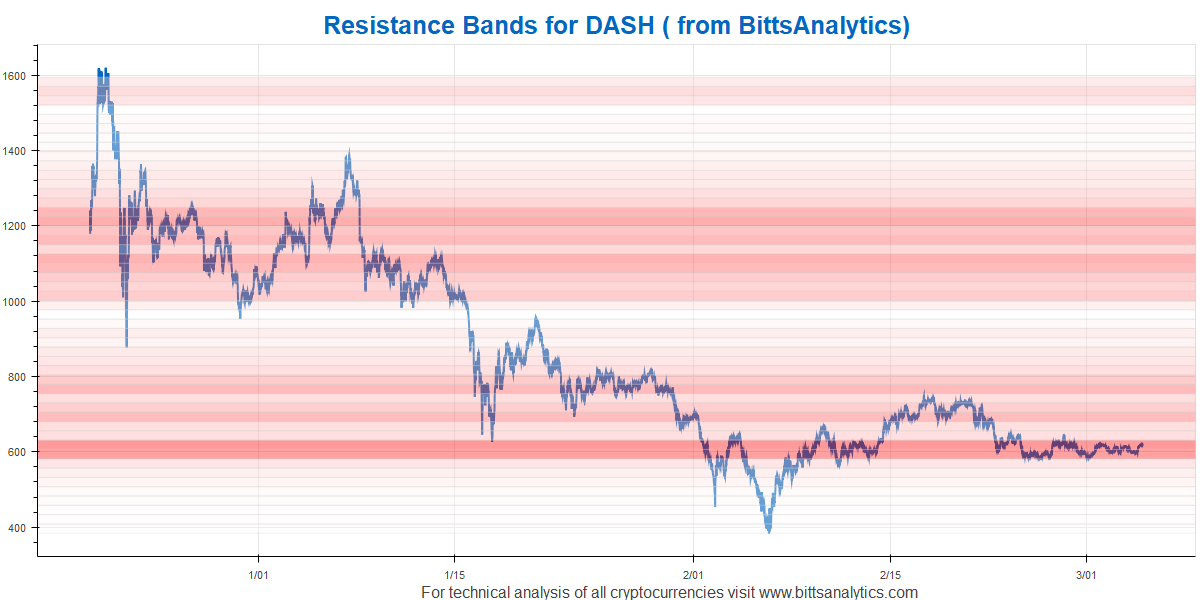

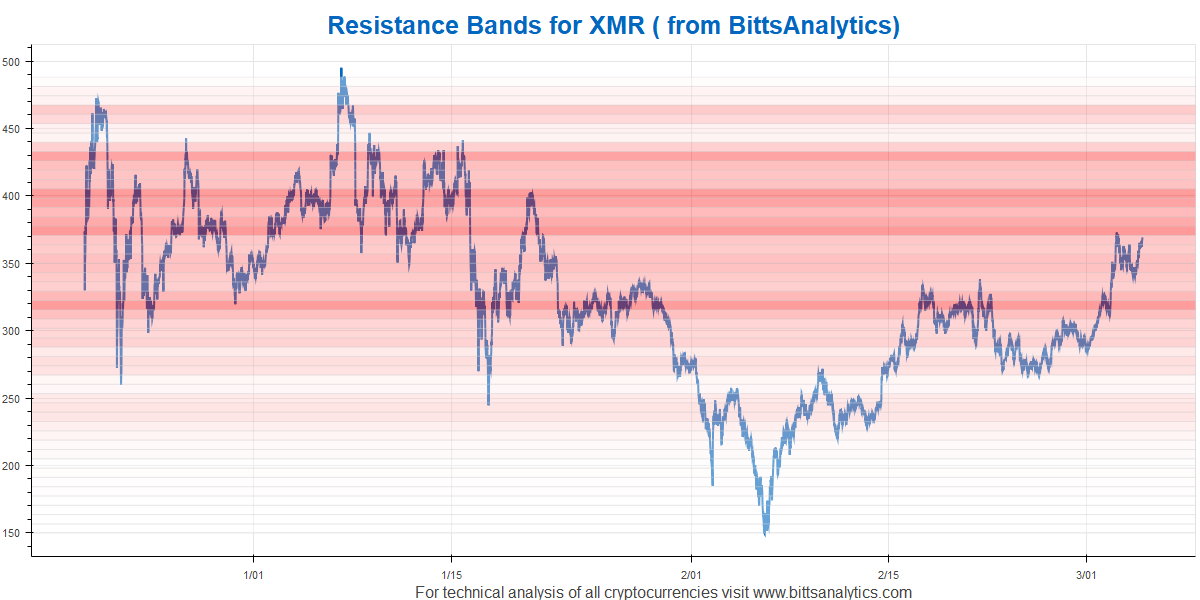

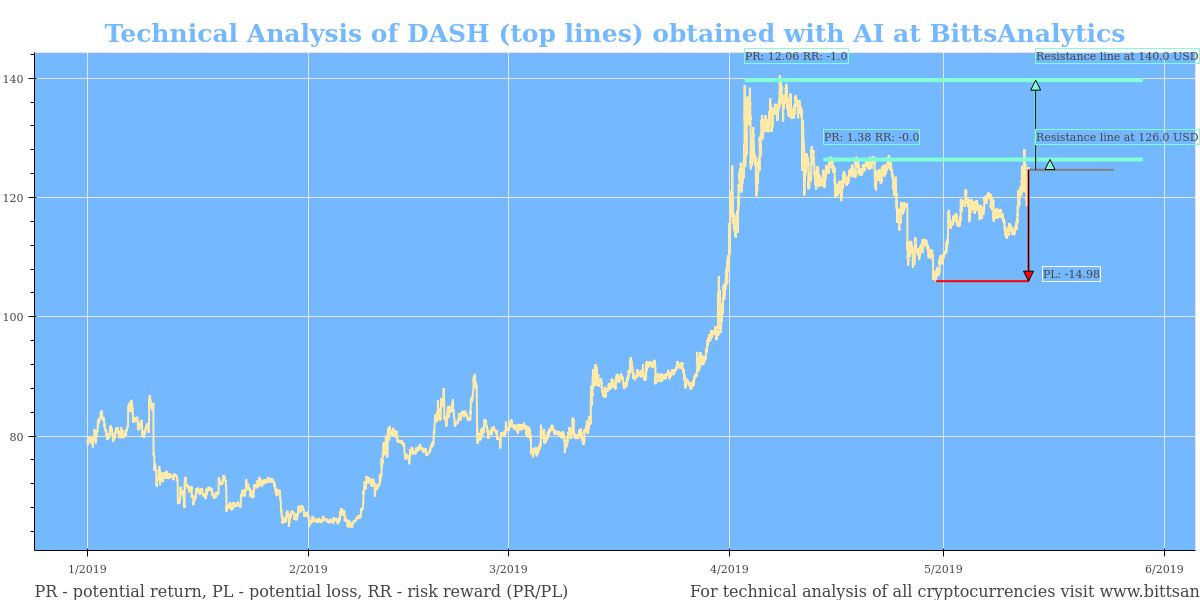

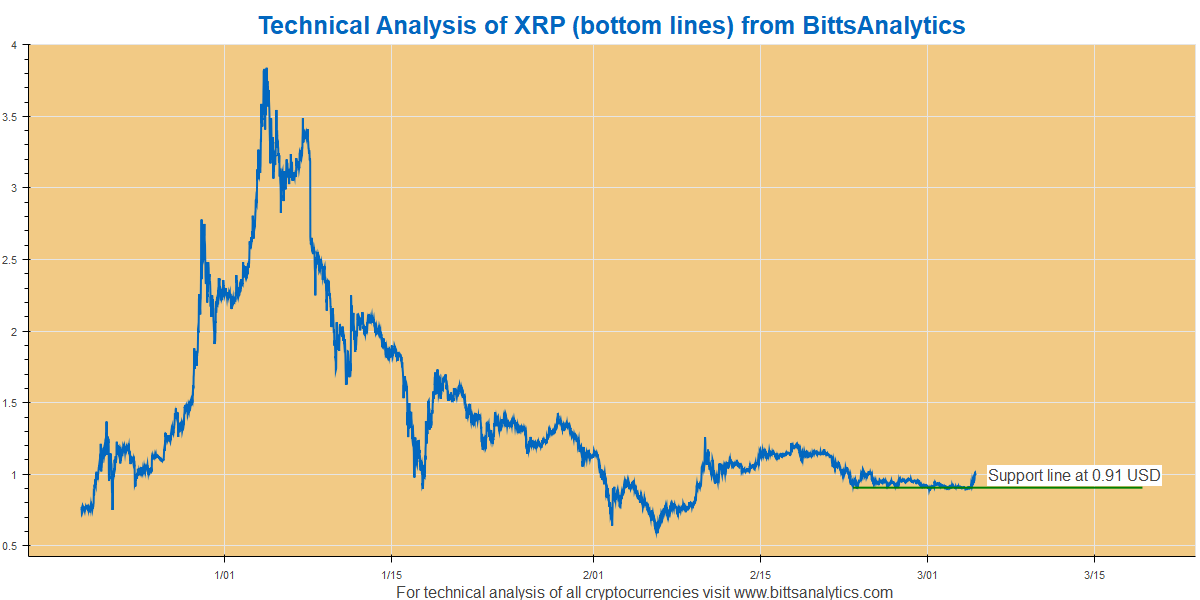

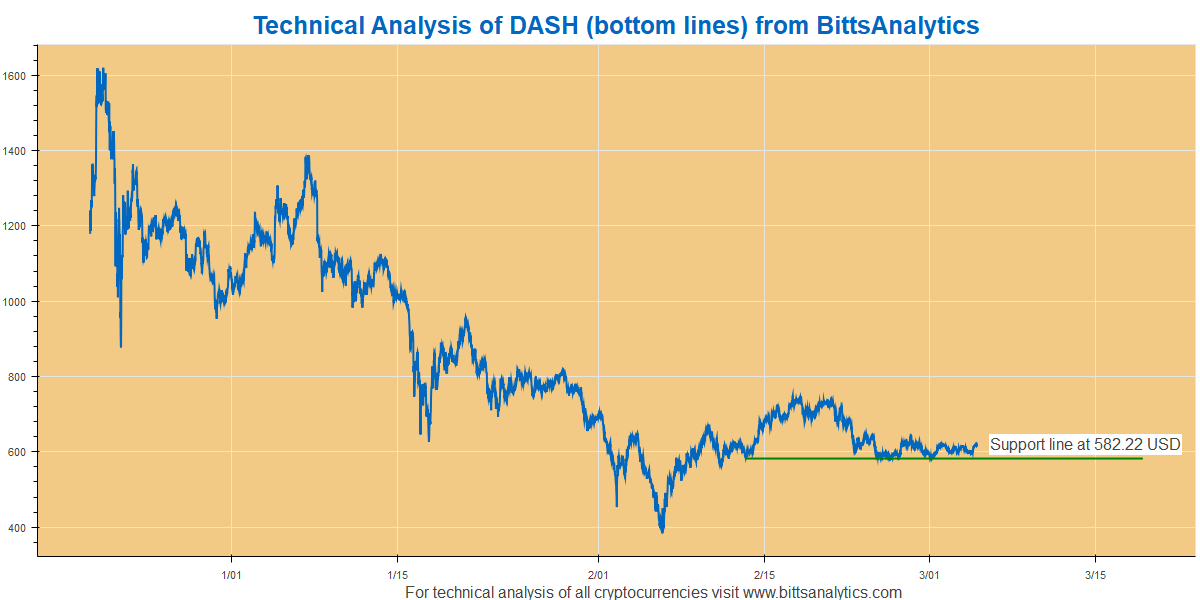

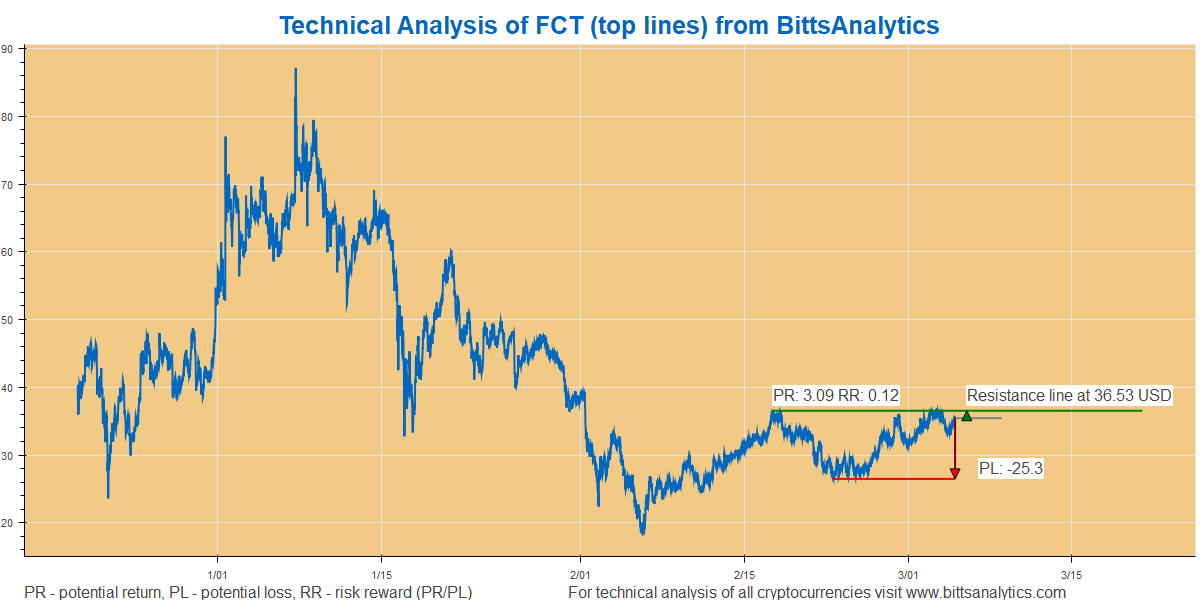

An important strategy that works both on ST and LT time horizons is based on assessing price resistance and support bands. This assessment is performed by looking at the historical trading volumes and using them to infer possible amounts of stop-loss or profit taking limits. These data is then used to generate price resistance and support bands which can be very useful for forecasting possible price paths of coins. For a case study of applying BittsBands to cryptocurrencies, please read our blog post about application on Bitcoin: BittsBands excellent predictor of price movements.

One of the classical approaches as a cryptocurrency investment startegy is to use technical analysis. This can include technical analysis indicators such as RSI, Bollinger bands but we have empirically observed that chart patterns perform remarkably well among the TA investment strategies. BittsAnalytics is one of the unique platforms in the crypto space in that it provides automated detection of chart patterns on a daily basis. For a case study of applying cryptocurrency technical analysis to Bitcoin, please read our blog post about application on Bitcoin: Double top pattern recognition worked greatly for the second time in a row flashing warning for Bitcoin at 9800 USD.

Cryptocurrency prices are driven like many other prices by supply and demand. But how can one gauge the level of demand at a particular time you may ask. Simple, one method is to simply look at the interest a particular currency is generating in social media and in news. This is what we are specialising at BittsAnalytics. We track millions of social media posts each day and calculating social media buzz for cryptocurrencies in real-time. For a case study of applying cryptocurrency social media mentions analysis to cryptocurrencies, please read an example blog post about application to Ripple: Ripple up more than 100% since a spike in social media mentions.

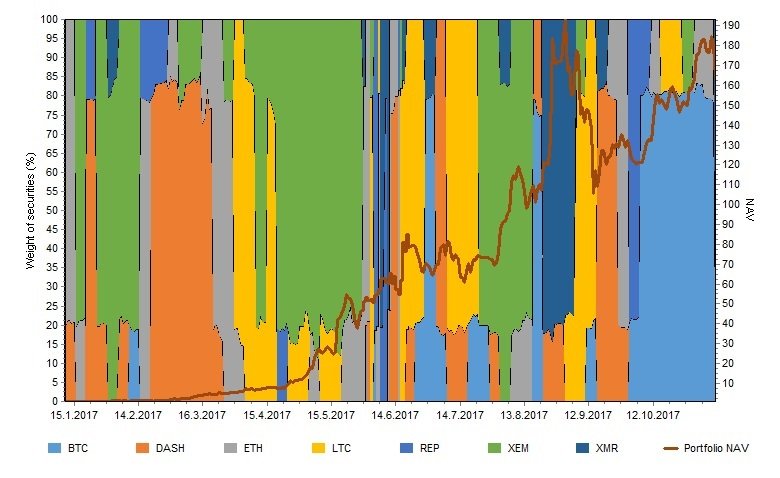

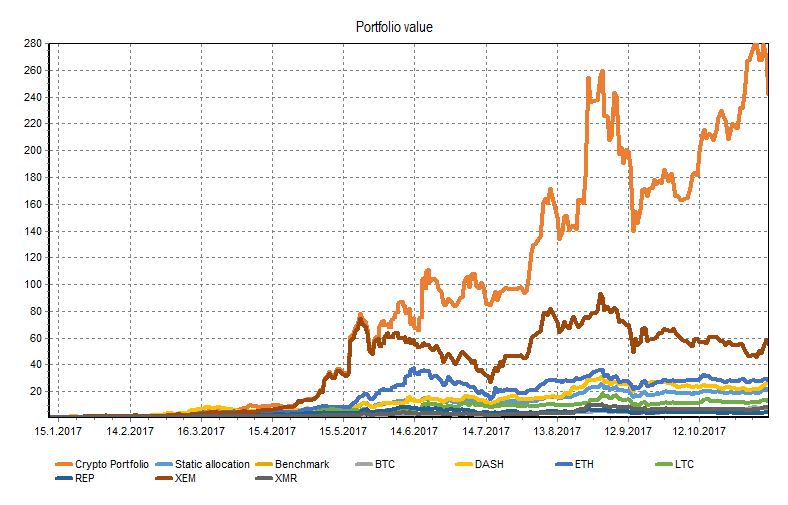

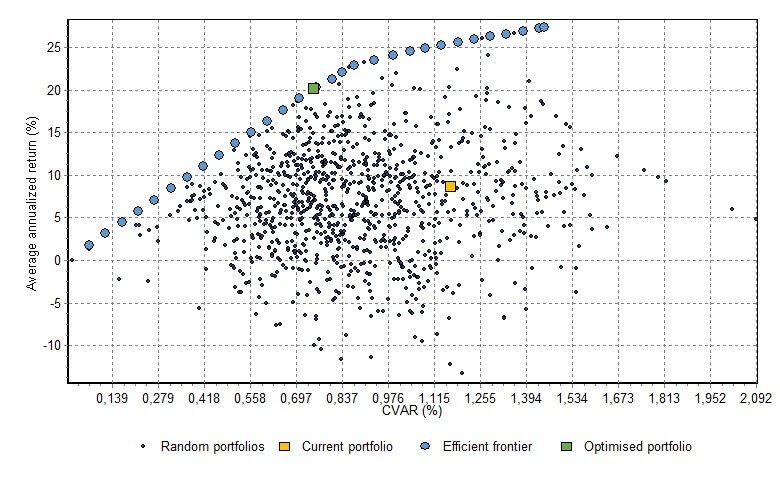

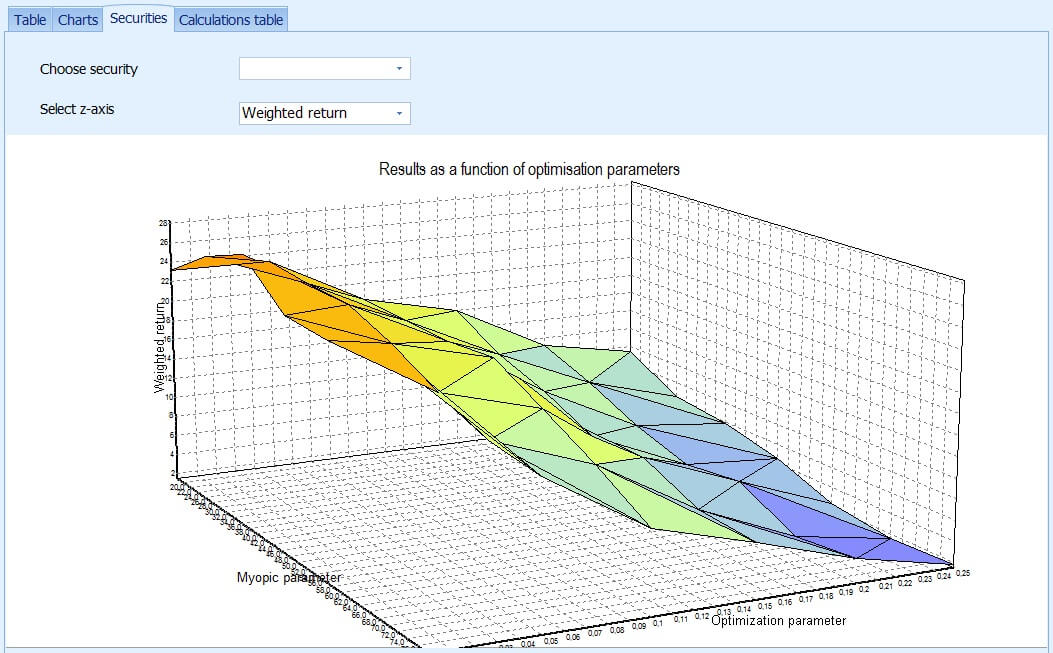

We have developed enterprise software for portfolio optimisation based on Mean CVaR method. Mean CVaR portfolio optimisation better captures fat tail events and is thus ideally suited for the volatile world of cryptocurrencies. Software also includes a powerful multiperiod portfolio optimisation framework for backtesting, construction and running of quantitative strategies. It uses deep learning to search for optimal parameters and allows construction of constant volatility, CVaR strategies.

Dynamic allocation between cryptocurrencies displays remarkable outperformance in the last few years even against demanding benchmarks like Ether and achieves this with lower risk. See our blog post for more information.

Quantitative strategies based on Mean CVaR portfolio optimisation are available as part of Advanced Subscription.About Us

BittsAnalytics is a leading analytics platform for cryptocurrencies, delivering social sentiment and other cryptocurrencies data since 2017.

Homepage:

www.bittsanalytics.com

Further Information

Company Contacts

Alpha Quantum

Franz-Joseph-Str.11

Munich

Germany

+49 (0)89 2153 68 219